ANZ Bank

Educating Australians on the dangers of cybercrime and assisting them in protecting what they own

What does a Cyber Education Service look like for ANZ Global?

The pace, scale and sophistication of cybercrime, scams and fraud have rapidly increased. Globally, there is a cyber attack every 39 seconds. ACCC reported a 50% increase in losses since last year, with $34M lost in scams in Australia in January 2022 alone. Not only do our customers suffer monetary loss, but it’s a stressful experience that reverberates across their lives, eroding their confidence in their ability to protect their assets, including loss of trust in digital banking.

Unsurprisingly, customer and regulator expectations of support from the finance industry to protect customers increased.

With concerns about education quality, consistency and timeliness, a cross-functional team was established to determine how ANZ could deliver and maintain comprehensive and practical customer education consistently across the Group.

My Role

Lead Service Designer

Client

ANZ Bank

Responsibilities

Project approach and planning

HCD training design

Led 12 person team

End-to-End Service Delivery

Design Research

Prototype and Concept

Business Case Development

Design Challenge

What does a Cyber Education Service look like for ANZ Global?

The design process had several critical challenges to work around.

A fully remote team was working across the multiple time zones of Australia Pacific.

A complex ecosystem and a bank-wide problem spaned all customer and banking types.

A tight deadline to remain compliant with governing bodies.

Christmas break and COVID-19 pressures.

Design Process

I strategically assigned specific research areas to the team and stakeholders to gain a comprehensive understanding of our business's challenges and current state in the Asia Pacific region.

This initiative effectively allowed us to navigate the complex ecosystem. Additionally, workshops with customer-facing staff complemented our desktop research, focusing on the critical needs of bankers and customers regarding cybercrime education. I developed a clear framework to organize our insights, which led to creating an impactful current state report. Our research identified three primary customer challenges, several significant business challenges, and actionable insights to address them effectively.

Customer challenges

Motivation

Motivating people to act (to educate and protect themselves and others)

Business challenges

Lack of Ownership

Educational content lacks ownership within ANZ. It is resulting in out-of-date content and confusion.

Access

Ease of access to educational information to educate themselves and others

Disparate Reach

Disparate Reach Knowledge of and access to resources across ANZ geographies and segments needs to be more cohesive.

Speed

Currency and speed of delivery of educational resources.

Duplication of work

Currently, discipline-led (Cyber security/ scams/fraud), not customer-led, creating duplication, in, efficiencies and competing priorities.

Falling Behind

Against key measures, ANZ currently needs to match the market's and customers' demands.

We then used these challenges to inform 'How might we statements to inform our design process and solutions.

We ran online ideation workshops with the core team and broader APAC stakeholder groups and conducted specialised idea development in collaboration with the vulnerable people's team.

We developed the prioritised ideas into concept posters and then prepared them for user testing. As a core team, we formed the concepts into a service framework hypothesis, which looked at the strategic factors needed for successful cyber education.

The customer research focussed on vulnerable customer groups, including culturally and linguistically diverse pensioners, people with a disability and low digital literacy levels.

We also looked for a range of participants whom CyberCrime had affected. Due to the low levels of digital literacy, we ran online and over-the-phone interviews. We developed the concepts for an auditory first environment.

The data collected in customer research formed four fundamental archetypes based on the expected behaviours of all our customers. Through workshopping the archetypes, we concluded that they are accurate daily across customers and institutional clients.

“Staff of businesses are ultimately just people too, and we all need to be educated about cyber security.”

Defining a value proposition for the service that meets the unique needs of customers.

The Solution

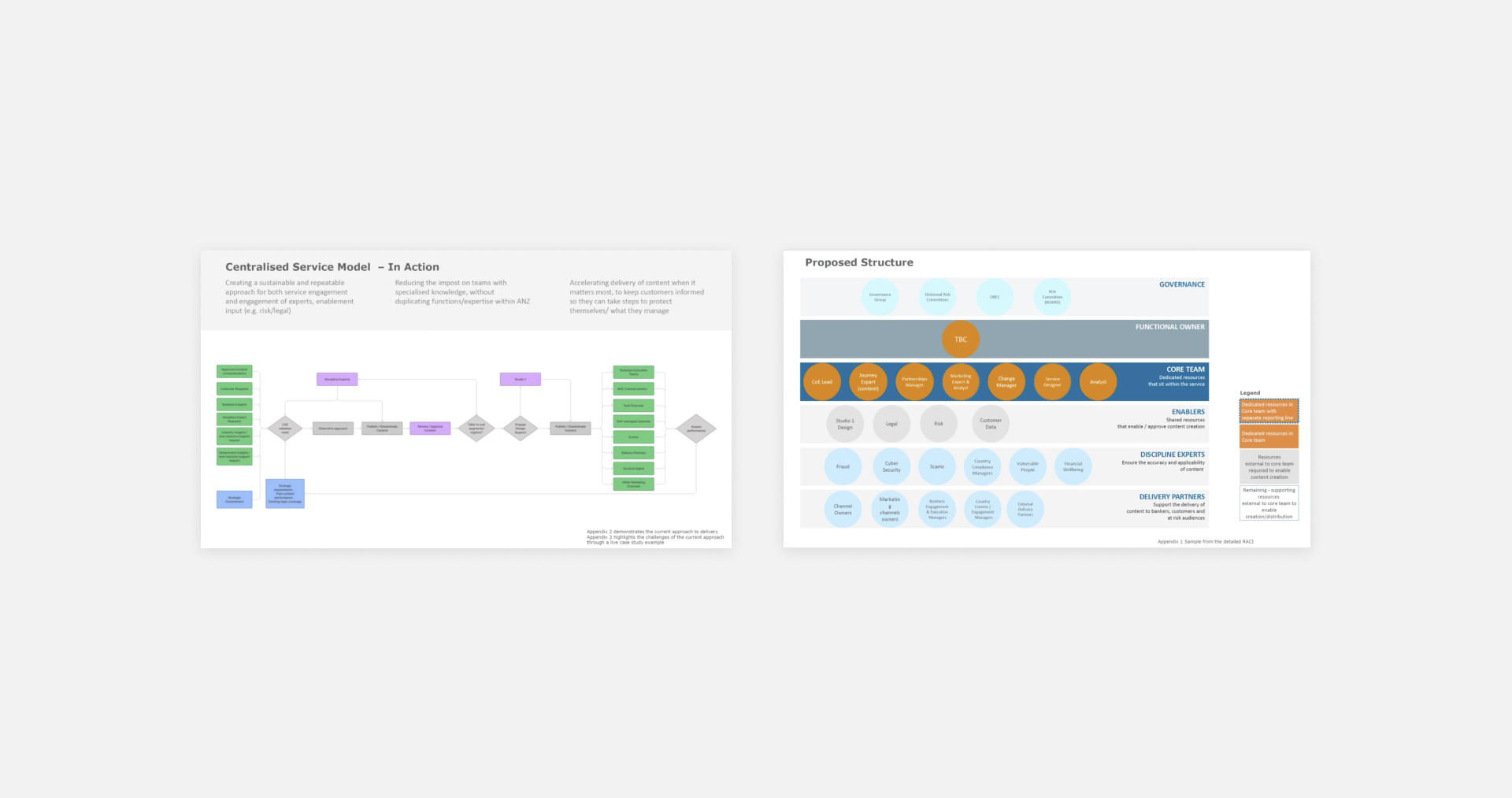

To implement the vision we needed a lean and centralised Customer Education Service that operates via a hybrid model to overcome the current ‘structural’ barriers to implement the strategy.

This team provides a single source of truth for content and business engagement. It will work with, but not duplicate, existing areas of expertise and customer communication. It will be global and agile and provide up-to-date content. Once established, this team will work with existing infrastructure to unify education services and provide the necessary speed, consistency and outcome analysis.

Project Praise

“the design team played a key role in leading and coaching to build understanding and trust in the process, nurture collaboration, and maintain active engagement from SMEs through to SteerCo members,”

The Result

The team prepared a compelling business case with four distinct goals (see opposite) that were funded and will be delivered in FY23.

The solution has been forecast to:

Reduce customer and ANZ gross exposure by 10%, equating to $10M pa saving in Australia alone.

Increase brand perception and customer trust, driving confidence and digital channel usage.

Achieve operational cost savings through reduced duplication of work globally.